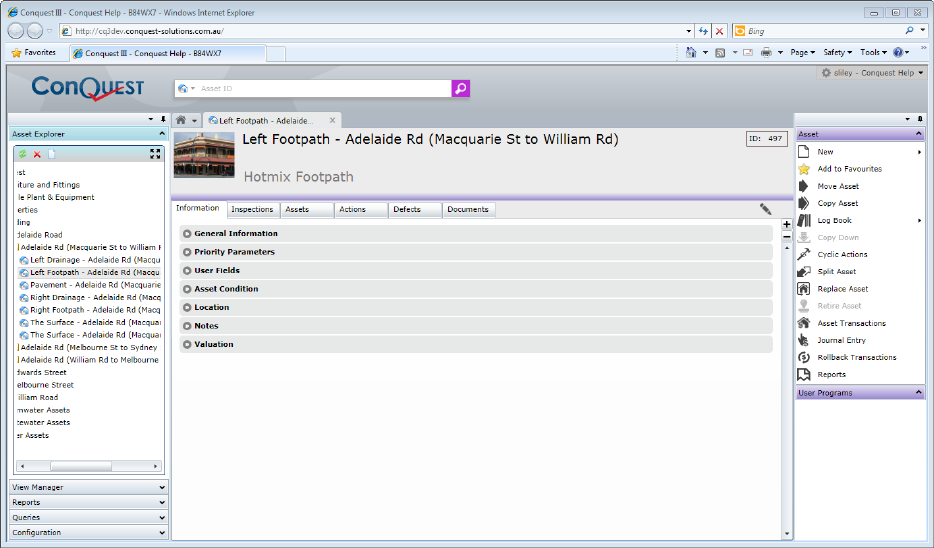

The Information tab holds a lot of information and has been grouped into major and minor sections for readability. Each major section can be expanded or collapsed by left-clicking on it.

The large + and - buttons on the right hand side of the form are used to expand or collapse all of the expander bars in the Information Tab with one left-click.

When the Asset form is closed, whatever combination of collapsed and expanded sections was present at close time, is presented the next time it is opened.

When the Asset Form is first opened, it is entirely read-only, with both the labels and data displayed without borders, until the Edit button to the right of the Tab strip, which is only present for Users with the Edit permission, is clicked. When that happens, the editable fields are given a border, while the non-editable fields remain borderless. The Edit button becomes two buttons, Save and Cancel until either is left-clicked, at which point the Edit button is reinstated and the fields become borderless again.

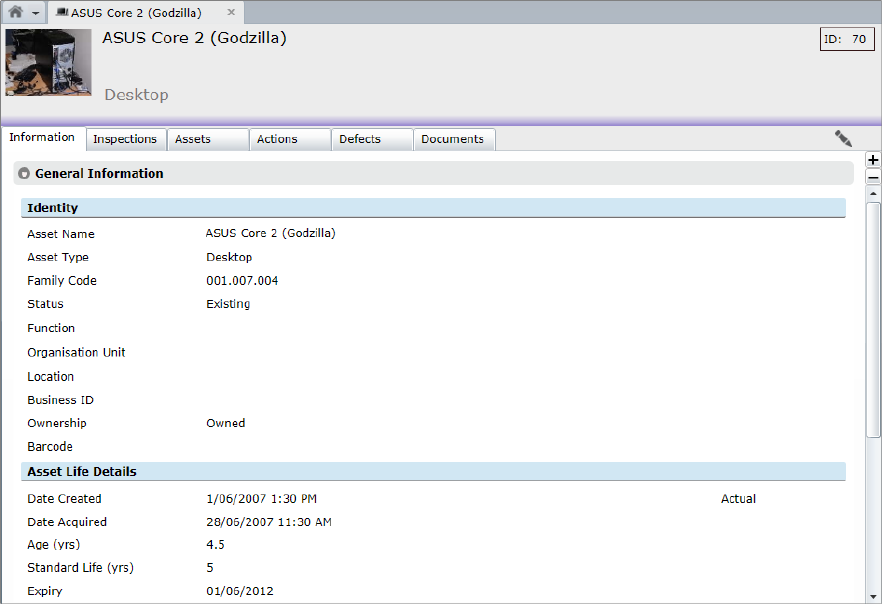

Identity

|

Field |

Description |

|

Asset Name |

The Asset Description or Name is entered here. It should be as distinctive as possible to make it easily recognisable. |

|

Asset Type |

Displays the description of the Type that the Asset belongs to. If the Asset is a placeholder or a grouping of other, real Assets, it does not have to be given an Asset Type. Asset Types are templates or standards set up in the Conquest Knowledge Base. |

|

Family Code |

A system generated code to identify the position of the Asset in the Asset Hierarchy. The form of the Asset Family Code is a series of three digit numbers separated with full stops e.g. ‘001.001.002’. There is no restriction on the number of levels, each containing as many as 999 Assets. When an Asset record is created, it is given a Family Code, which it keeps until such time as it is moved to somewhere else in the hierarchy, where it is given the first available, unallocated Family Code, one greater than the highest existing child Asset Family Code. When 999 is reached and there are gaps in the range of FamilyCodes caused by Cut/Paste operations, new Assets will be allocated numbers from the gaps until all the gaps are filled, at which point no further new Assets can be created for that parent. |

|

Asset Status |

Used for Valuation purposes, this field displays the status of the Asset and can be •Proposed •Existing •Disposed - also used for Retired Assets |

|

Function |

Displays the description of the Function allocated to this Asset, commonly based on a Financial Class in the General Ledger. The Functions are set up in the Function Editor. See Functions.|topic=Functions |

|

Organisation Unit |

Displays the description of the person or department, within the organisation, made responsible for the Asset. See Organisational Units.|topic=Organisational Units |

|

Business ID |

For example ‘RL 4748PA’. This field is for recording a user definable, unique asset ID other than that provided by Conquest. |

|

Class or Ownership |

This field is a list that can be configured in the Code Editor. It is used to show the ownership status of the asset. |

|

Barcode |

If an Asset has a barcode it can be entered here. |

|

Hidden Fields |

Three hidden Asset fields are provided for administrative purposes. These are AddingMethod, AddingUser and AddingDate, which record how, who and when an Asset is added to Conquest and can be accessed through external means. AddingMethod has code values as follows: •0 for unknown or old Assets •1 for inserted Assets •2 for imported Assets •3 for copy pasted Asset •4 for Conquest Collect •5 for split Assets •6 for Assets added through the RSM (Road Surface Manager - an additional product available from Conquest Software) |

|

Map Status |

This field indicates whether an Asset has been mapped or not. |

|

|

|

Asset Life Details

|

Field |

Description |

|

Date Created |

This date can be manually entered or gets its value from the completion date of a Purchase or New Works Action processed on the Proposed Asset. This is the date that the Asset was constructed. This date can be marked Actual or Estimated. As many Assets will be quite old and accurate construction records may not exist, an estimated date can be entered. This date is the Asset Life start date and is used in Asset Valuations, particularly the Batch Valuation by Age process. See the Batch Valuation How To by age process. |

|

Date Acquired |

If an asset has been acquired rather than constructed, the acquisition date can be recorded here. Valuations still use the Date Created to determine Asset Life. |

|

Age (years) |

Calculated by the difference between the date created and today. |

|

Standard Life (years) |

This is the standard expected life for this Asset as defined by its Asset Type. |

|

Expiry |

This date is the expected end of life date for this Asset. This is automatically calculated the first time an asset’s date created and standard life is specified. Thereafter it can be changed manually in the Valuation section of this form or calculated by the Expiry Date Calculator. |

|

Expected Life |

This is calculated by the difference between the date created and the expiry date. |

|

Remaining Life |

This is calculated by the difference between the expiry date and today. |

|

|

|

Warranty Details

|

Field |

Description |

|

Warrantor |

The name of the organisation providing a Warranty on the Asset. |

|

Warranty Expiry |

The date that the Asset Warranty expires. If an Action is created on the Asset, while still under warranty, a warning message will be displayed. |

|

|

|

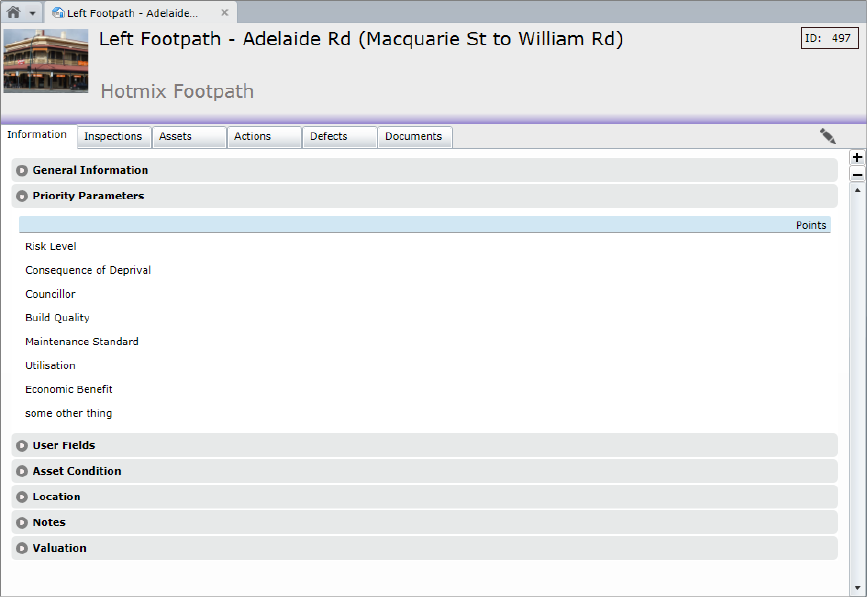

Priority Parameters

Eight fields to record ratings against an Asset that will help in prioritising it for works to be carried out. Priority Rating lists are configured in the Code Editor under System Lists and are also used to create Priority Scenarios in the Asset Priority Report.

There are two sets of User Fields that can be used to further identify Assets, namely the System User Fields and the Asset Type User Fields.

System User Fields

These are configured in the System Options and are applicable to all Assets, while the Asset Type User Fields are configured in an Attribute Set and only applies to Assets of this Asset Type.

There are; 8 Text, 2 Number, 2 Date, 2 Check, 4 List and 2 User Hierarchy fields that can be defined.

Asset Type User Fields

These are categorised and stored in Asset Attribute Sets as:

•10 Condition Lists (configured in the Code Editor under Condition Lists

•8 Dimensions

•8 Environment Lists (configured in the Code Editor under System Lists

•30 each of User Defined:

•Texts

•Numbers

•Dates

•Check Boxes

•Lists (configured in the Code Editor under User Lists)

The Asset form displays only those fields that have been defined for its Asset Type.

Of the 8 Dimension fields, one can be chosen to be the Dimension to Value by defined for financial purposes, in the Asset Type (for example Length). Conquest uses the value in this field, when calculating the Replacement Cost for an Asset.

The 8 Environment Lists are purely informational, to assist in explaining the condition of Assets subjected to Environmental factors.

Conquest displays an Overall Condition, which can be:

•Calculated from the Condition Attribute values selected or entered on the Asset, or…

•Manually, by ticking the Manual Condition Calculation check box on the Asset then selecting a Condition from the System Condition List

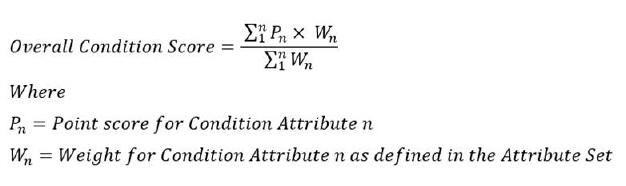

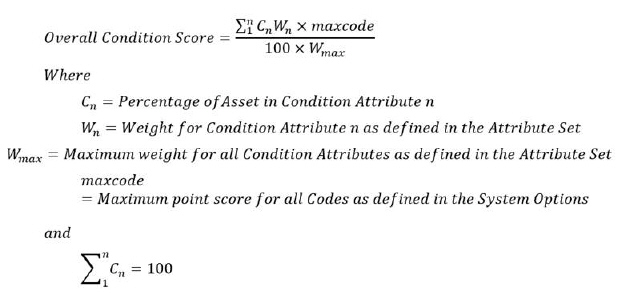

Calculation of Overall Condition is performed on the Condition Attributes fields for the Asset, to get a Condition Point value based on either of the following two methods:

Weighted Average

Condition Distribution

Having done the calculation, Conquest gets the item from the System Condition List that has a Points value closest to the calculated Condition Point, and uses its description for the Overall Condition.

Things to be aware of:

•Condition Attributes are defined in the Asset Type

•Manually selected Condition overrides any individual Condition Attributes that might have been set previously

•The minimum and maximum Code Point values need to be set in the System Options. See System Options for details

•Condition Attributes can be given a weight for the purpose of calculating a weighted average, Overall Condition e.g. the first condition might be weighted at 4, while the second is at 2, which would mean that the first Condition will be calculated as twice as significant as the second

•For Weighted Average to return an Overall Condition Score, all of the Condition Attributes must be set

•For Condition Distribution to return an Overall Condition Score, the Condition Attributes entered, must add up to 100

•A default list for the Overall Condition is provided in the Code Editor under System Lists, which can be amended but not deleted. However, you can create your own lists under the Condition Lists category

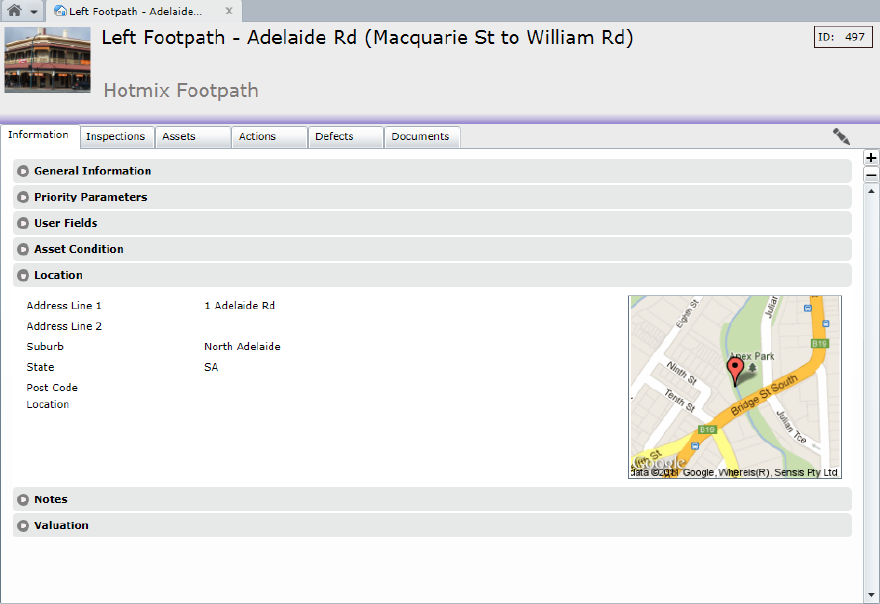

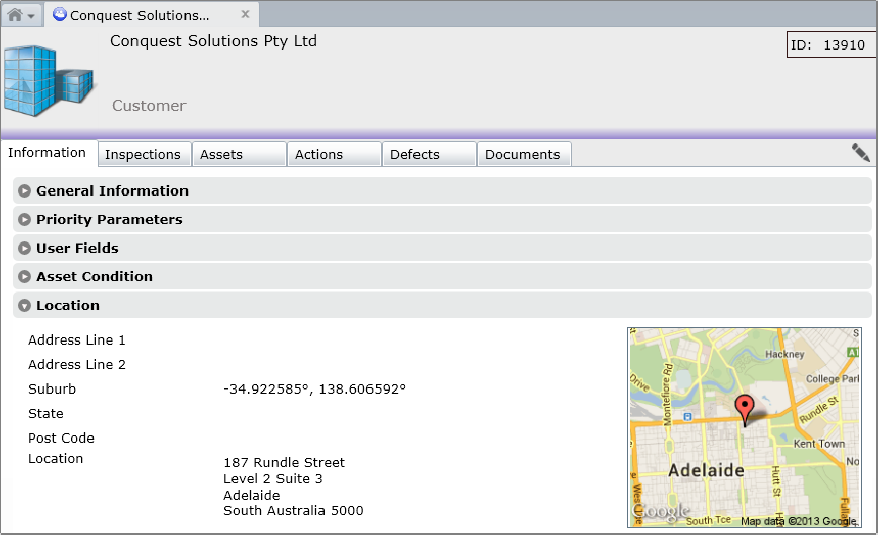

The fields in this section are used to provide details of the address and any relevant notes on the location of an Asset. When a sufficiently accurate address is present, a Google Mini-map is displayed to the right of it. Entering a Latitude and Longitude can give an exact location on the Map but is best done as described below.

Because downloading the image to the client PC could be considered a security vulnerability by some organisations, a System Option - Fetch Google Map behaviour is provided to manage this feature. See General Options for details.

When a Latitude and Longitude is used, for best results format all of the textual address details into the Location field and put the Lat/Long values into Suburb, leaving all the other address fields empty:

The Mini-map can be left-clicked to open the full Google Map in a new browser tab.

Notes

The notes field can be as much descriptive text about an Asset as is necessary and can be quickly scanned, without having to open attached documents, which might be too detailed to be easily understood.

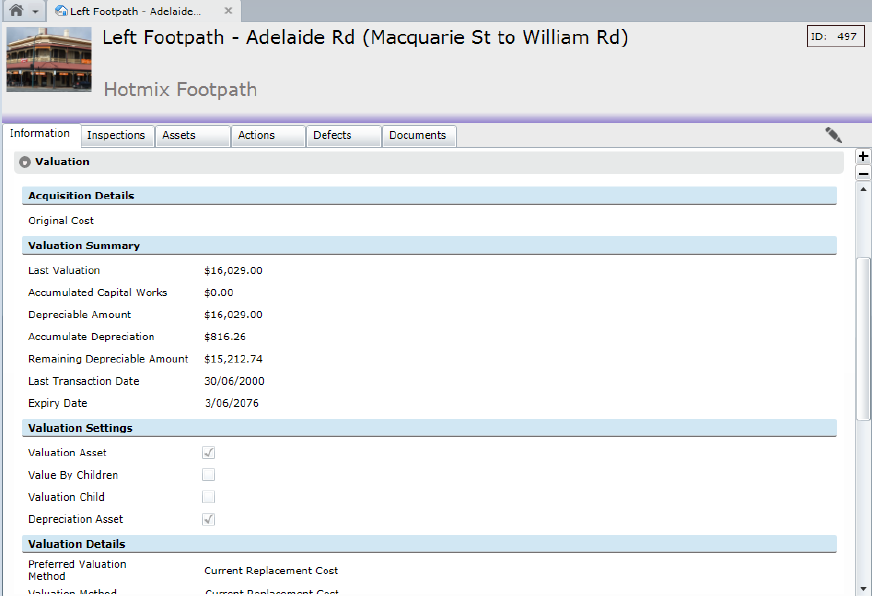

This section of the form shows the current valuation information for an Asset, marked as a Valuation Asset to be able to hold information in this section. This section is broken down into a sub-sections.

The current value of the Asset is shown in the Remaining Depreciable Amount, which is a result of this calculation:

Asset Value = Last Valuation + Accumulated Capital Works - Assessed Residual Value - Accumulated Depreciation

|

Field |

Description |

|

Original Cost |

The original purchase/construction cost of the Asset. This amount can be entered manually or will be taken from the cost specified on the purchase or New Works Action processed against the Proposed Asset. |

|

Last Valuation |

The amount is the value of the Asset as calculated during a revaluation process, or as specified on a Journal Transaction. The Revaluation Process uses the Replacement Cost Rate as specified on the Asset Type, multiplied by the measurement of the Asset. Note: the Replacement Cost amount and the Last Valuation amount may differ. |

|

Accumulated Capital Works |

Displays the total Capital Works expenditure recorded against an Asset since the last valuation. The amount is the sum of all the costs as specified on the New Works Actions processed against the Asset or as specified on a Journal transaction. When using a Journal to amend the value, also provide the total Accumulated Capital Works amount. |

|

Depreciable Amount |

Calculated by adding the Last valuation and the Accumulated Capital Works amounts and then subtracting the Assessed Residual Value. The result is the full amount by which the Asset can be depreciated. |

|

Accumulated Depreciation |

The amount that an Asset has depreciated up to the Last Transaction Date. This is a calculated field, for which the Depreciation Charge is calculated |

|

Remaining Depreciable Amount |

This is the Amount remaining, to be depreciated, as at the Last Transaction Date. |

|

Last Transaction Date |

Date of the last recorded valuation transaction (Valuation, Depreciation, Purchase, New Works, Disposal, Journal Adjustment), displayed as the Closing Period in the Asset Transactions list. Further financial transactions dated prior to the Last Transaction Date cannot be processed without rolling back existing transaction to bring the date back. See Rolling Back. |

|

Expiry Date |

Displays the Expiry Date as calculated and can be manually changed here. It is a mandatory field on a Depreciable Asset. |

|

Valuation Asset |

This check box determines whether the Asset will be valued. This is set from the Asset Type but can be unchecked here if this Asset is not to be valued. Once an asset has been valued, un-checking this check box will cause the value to be written back and will be recorded as a Write Back transaction. |

|

Value by Children |

Selecting this in conjunction with the Valuation Asset checkbox will cause this Asset to be valued by the standard rates of Assets below it in the hierarchy that have the Valuation Child checkbox ticked, rather than its own. |

|

Valuation Child |

Selecting this checkbox ensures that a higher-level Asset will use this Asset’s rate to determine value, rather than its own. For Valuation Child to be selected, there must be another Asset higher above it in the hierarchy that is defined as a Valuation Asset and has the Value by Children checkbox ticked. |

|

Depreciation Asset |

When checked, indicates that the Asset will be depreciated; the default comes from the Asset Type. If the Asset is not to be depreciated, for whatever reason, un-check this box. |

|

Preferred Valuation Method |

This field displays the preferred method for valuing this asset as specified on the Asset Type. Methods are: •Current Replacement Cost •Deprival Method •Current Market Price •Disposal Value. |

|

Valuation Method |

The Method of valuation used for the Asset. |

|

Valuer |

The Conquest user, who performed the last Valuation. |

|

Valuation Date |

Is the date of the last Valuation or the Completion Date of the last New Works Action on the Asset. |

|

Valuation Cycle (Years) |

Is the standard number of years between valuations, from the Asset Type. |

|

Modify Valuation Cycle By (Years) |

Enter a number of years to reduce or increase the Valuation Cycle by (use a negative number to reduce). |

|

Next Valuation |

The Scheduled Date for next Valuation. |

|

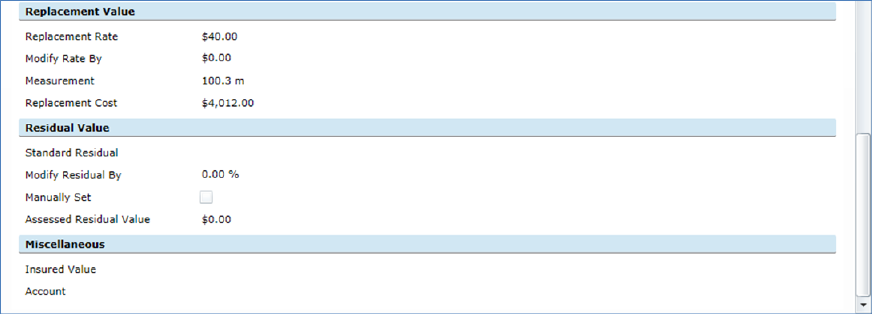

Replacement Rate |

Is the standard Replacement Rate for the Asset, taken from the Asset Type. |

|

Modify Rate by |

Enter an amount to reduce or Increase the standard Replacement Rate by. |

|

Measurement |

This value is either entered manually or is taken from the Dimension To Value By specified on the Asset Type. |

|

Replacement Cost |

This amount is calculated as the sum of Replacement Rate and Modify Rate By figures multiplied by Measurement. This value is an indication of the cost to replace this Asset and not necessarily equal to the current value of the Asset. |

|

Standard Residual |

Displays the percentage of value left in an Asset when the Asset ends its life; specified in the Asset Type. |

|

Modify Residual By |

You can reduce or increase the percentage of Residual Life of an Asset. |

|

Manually Set |

Determines whether the Assessed Residual Value will be calculated or entered manually. |

|

Assessed Residual Value |

The value displayed here can be: •Entered manually to a value determined outside of Conquest - the Manually Set check box should be set to true •Calculated using information specified in Conquest. The calculation is done when an Asset is revalued or purchased. The formula is: Revaluation: (Replacement Cost Rate * measurement) * (Standard Residual percentage plus or minus Modify Residual by percentage) Purchased: Cost of purchase * (Standard Residual percentage plus or minus Modify Residual by percentage where the Standard Residual percentage is specified on the Asset Type and the Modify Residual on the Asset. Note that once the Residual Value is calculated, it only changes upon a further revaluation, or when manually set. |

|

Insured Value |

For recording the Insured Value of an Asset. |

|

Account Number |

A financial system Account Number can be recorded here. |

|

|

|