Step 1. Make sure that the Assets you are valuing (in your filter) have:

•A Status of ‘Existing’

•The ‘Valuation Asset’ checkbox ticked

•A ‘Measurement’

•The ‘Depreciation Asset’ checkbox ticked for Assets that are to be valued by the Age and Condition methods

•A ‘Date Created’ for the ‘Replacement Value’ and ‘Age’ methods

•A ‘Condition’ for the ‘Condition’ and ‘Condition at Inspection Date’ methods

•An Asset Type with both:

•A ‘Standard Life’

•A ‘Replacement Cost Rate’

•An Optional ‘Modify Rate By’

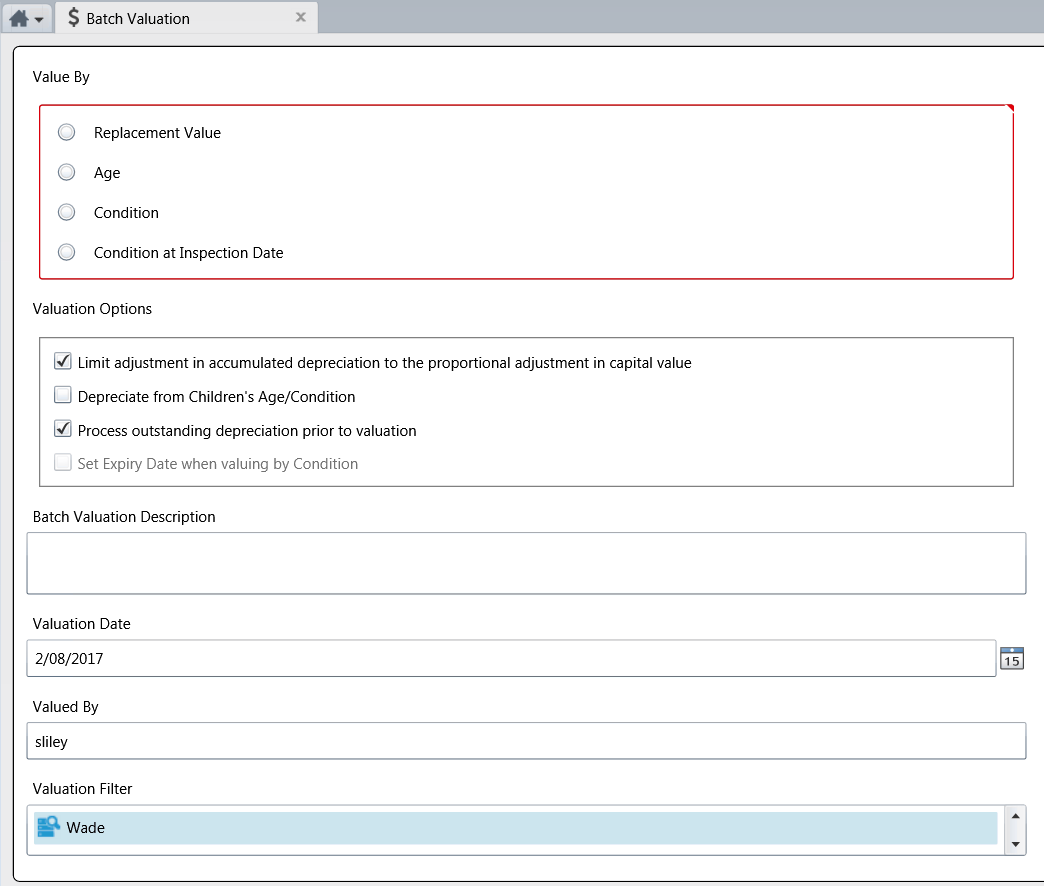

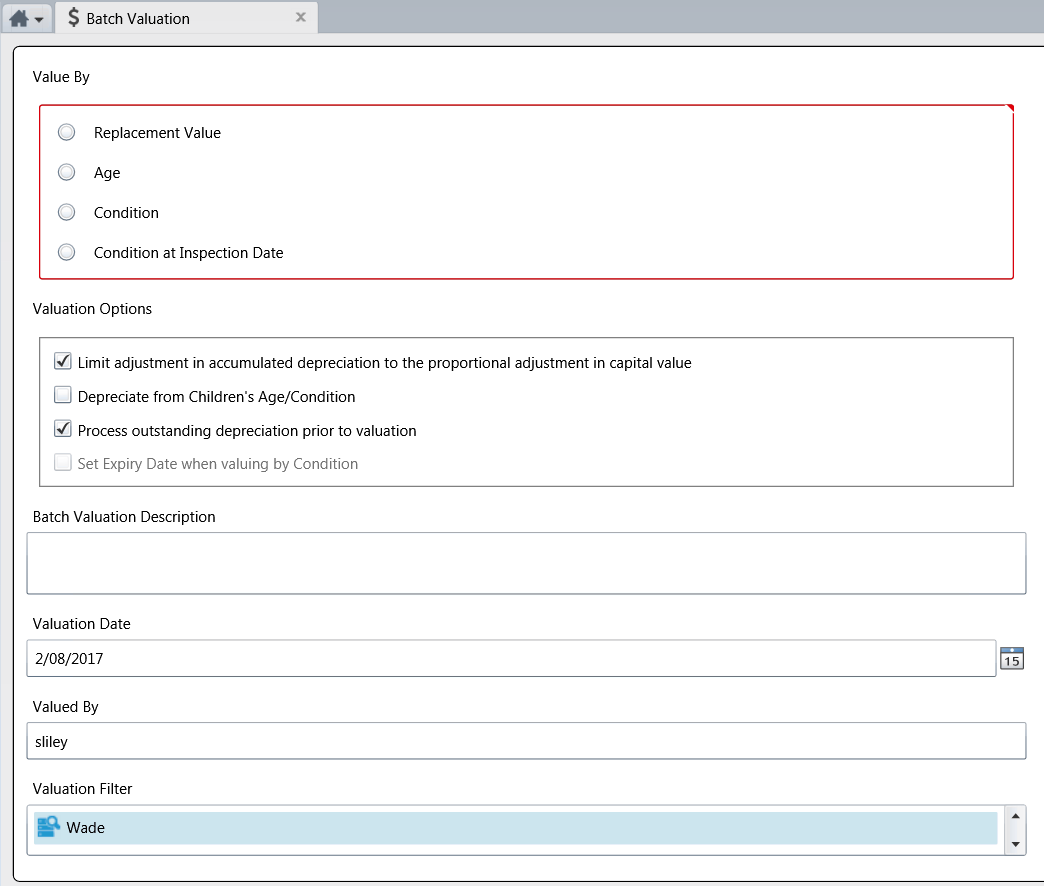

Step 2. Select a ‘Value By’ Method:

Step 3. Choose a valuation method

Step 4. When you choose the Replacement Value method it:

•Sets Expiry Date to ‘Date Created’ + ‘Standard Life’ of the Asset Type)

•Sets Last Valuation to Current Replacement Cost, calculated as; (‘Measurement’ * (‘Replacement Cost Rate’ + ‘Modify Rate By’))

•Creates a Transaction Log record to show the difference between; (previous ‘Last Valuation’ + ‘Accumulated Capital Works’) and the new ‘Last Valuation’ value

•Sets the Accumulated Capital works to zero (0)

•Sets the Accumulated Depreciation to zero (0)

•Options:

•Tick Process outstanding depreciation prior to valuation, unless there is good reason not to generate a Depreciation Transaction for the period since the last transaction

Step 5. When you choose the Age method it:

•Sets Expiry Date to ‘Date Created’ + ‘Standard Life’ of the Asset Type)

•Sets Last Valuation to Current Replacement Cost, calculated as; (‘Measurement’ * (‘Replacement Cost Rate’ + ‘Modify Rate By’))

•Sets the Accumulated Capital works to zero (0)

•Calculates the new Accumulated Depreciation as; (Last Valuation * (‘Age’ / ‘Useful Life’), where:

•‘Age’ is the time between the ‘Transaction Date’ and the ‘Date Created’

•Useful Life is the time between the ‘Expiry Date’ and the ‘Date Created’

•Options:

•Tick Limit adjustment in accumulated depreciation to the proportional adjustment in capital value, unless there is good reason not to

•Tick the ‘Depreciate from Children’s Age / Completion’ Option to use the age of Valuation Child Assets to calculate the ‘Accumulated Depreciation’ of the Valuation Asset they belong to. See Depreciation Charges for more details.

Step 6. When you choose the Condition method it:

•Sets Last Valuation to Current Replacement Cost, calculated as; (‘Measurement’ * (‘Replacement Cost Rate’ + ‘Modify Rate By’))

•Sets the Accumulated Capital works to zero (0)

•Calculates the new Accumulated Depreciation as; ((‘Replacement Cost Rate’ + ‘Modify Rate By’) * Measurement - Residual Value) * (Condition Point / Condition at End of Life)

Step 7. Choose Options:

•Tick Limit adjustment in accumulated depreciation to the proportional adjustment in capital value, unless there is good reason not to

•Tick Depreciate from Children’s Age / Completion to use the Condition of Valuation Child Assets to calculate the ‘Accumulated Depreciation’ of the Valuation Asset they belong to

•Tick Set Expiry Date when valuing by Condition to set the ‘Expiry Date’ as; Valuation Date + (Standard Life - (Condition Point of the Asset / Code Point at End of Life set on the Asset Type) * (Standard Life * 365.25)). See Valuation by Condition for more details.

Step 8. When you choose the Condition at Inspection Date method it:

•Sets Last Valuation to Current Replacement Cost, calculated as; (‘Measurement’ * (‘Replacement Cost Rate’ + ‘Modify Rate By’))

•Sets the Accumulated Capital works to zero (0)

•Performs the calculation of Depreciation as for Condition method (above) but creates a further Asset Transaction. See Valuation by Condition at Inspection Date for more details.

Step 9. Choose Options:

•Tick Limit adjustment in accumulated depreciation to the proportional adjustment in capital value, unless there is good reason not to

•Tick Depreciate from Children’s Age / Completion to use the Condition of Valuation Child Assets to calculate the ‘Accumulated Depreciation’ of the Valuation Asset they belong to

•Tick Set Expiry Date when valuing by Condition to set the ‘Expiry Date’ as; Inspection Date + (Standard Life - (Condition Point of the Asset / Code Point at End of Life set on the Asset Type) * (Standard Life * 365.25))

Note: Make sure you use a meaningful Batch description, to aiist with identification should you need to do a Batch Rollback.