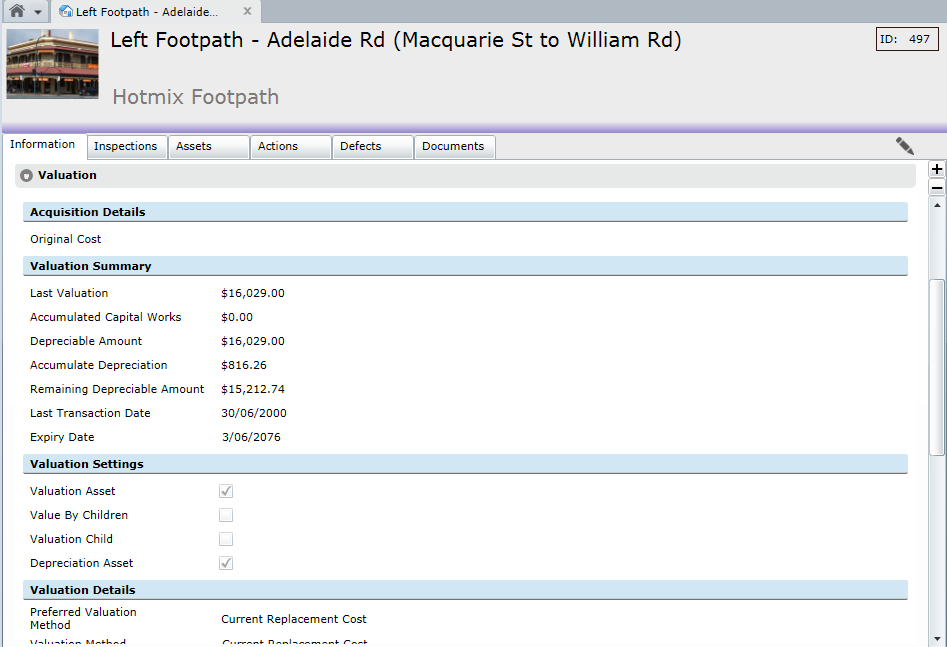

This section of the form shows the current valuation information for an Asset, marked as a Valuation Asset to be able to hold information in this section. This section is broken down into a sub-sections.

The current value of the asset is shown in the Remaining Depreciable Amount, which is a result of this calculation:

Asset Value = Last Valuation + Accumulated Capital Works - Assessed Residual Value - Accumulated Depreciation

|

Field |

Description |

|

Original Cost |

The original purchase/construction cost of the Asset. This amount can be entered manually or will be taken from the cost specified on the purchase or New Works Action processed against the Proposed Asset. |

|

Last Valuation |

The amount is the value of the Asset as calculated during a revaluation process, or as specified on a Journal Transaction. The Revaluation Process uses the Replacement Cost Rate as specified on the Asset Type, multiplied by the measurement of the Asset. Note: the Replacement Cost amount and the Last Valuation amount may differ. |

|

Accumulated Capital Works |

Displays the total Capital Works expenditure recorded against an Asset since the last valuation. The amount is the sum of all the costs as specified on the New Works Actions processed against the Asset or as specified on a Journal transaction. When using a Journal to amend the value, also provide the total Accumulated Capital Works amount. |

|

Depreciable Amount |

Calculated by adding the Last valuation and the Accumulated Capital Works amounts and then subtracting the Assessed Residual Value. The result is the full amount by which the Asset can be depreciated. |

|

Accumulated Depreciation |

The amount that an Asset has depreciated up to the Last Transaction Date. This is a calculated field, for which the Depreciation Charge is calculated. |

|

Remaining Depreciable Amount |

This is the Amount remaining, to be depreciated, as at the Last Transaction Date. |

|

Last Transaction Date |

Date of the last recorded valuation transaction (Valuation, Depreciation, Purchase, New Works, Disposal, Journal Adjustment), displayed as the Closing Period in the Asset Transactions list. Further financial transactions dated prior to the Last Transaction Date cannot be processed without rolling back existing transaction to bring the date back. See Rolling Back. |

|

Expiry Date |

Displays the Expiry Date as calculated and can be manually changed here. It is a mandatory field on a Depreciable Asset. |

|

Valuation Asset |

This check box determines whether the Asset will be valued. This is set from the Asset Type but can be unchecked here if this Asset is not to be valued. Once an asset has been valued, un-checking this check box will cause the value to be written back and will be recorded as a Write Back transaction. |

|

Value by Children |

Selecting this in conjunction with the Valuation Asset checkbox will cause this Asset to be valued by the standard rates of Assets below it in the hierarchy that have the Valuation Child checkbox ticked, rather than its own. |

|

Valuation Child |

Selecting this checkbox ensures that a higher-level Asset will use this Asset’s rate to determine value, rather than its own. For Valuation Child to be selected, there must be another Asset higher above it in the hierarchy that is defined as a Valuation Asset and has the Value by Children checkbox ticked. |

|

Depreciation Asset |

When checked, indicates that the Asset will be depreciated; the default comes from the Asset Type. If the Asset is not to be depreciated, for whatever reason, un-check this box. |

|

Preferred Valuation Method |

This field displays the preferred method for valuing this asset as specified on the Asset Type. Methods are: •Current Replacement Cost •Deprival Method •Current Market Price •Disposal Value. |

|

Valuation Method |

The Method of valuation used for the Asset. |

|

Valuer |

The Conquest user, who performed the last Valuation. |

|

Valuation Date |

Is the date of the last Valuation or the Completion Date of the last New Works Action on the Asset. |

|

Valuation Cycle (Years) |

Is the standard number of years between valuations, from the Asset Type. |

|

Modify Valuation Cycle By (Years) |

Enter a number of years to reduce or increase the Valuation Cycle by (use a negative number to reduce). |

|

Next Valuation |

The Scheduled Date for next Valuation. |

|

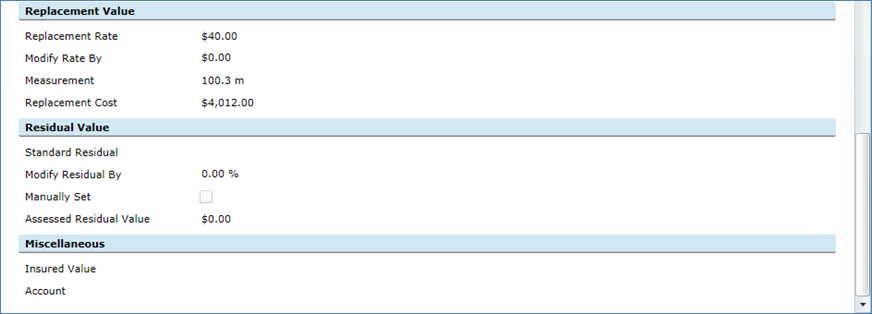

Replacement Rate |

Is the standard Replacement Rate for the Asset, taken from the Asset Type. |

|

Modify Rate by |

Enter an amount to reduce or Increase the standard Replacement Rate by. |

|

Measurement |

This value is either entered manually or is taken from the Dimension To Value By specified on the Asset Type. |

|

Replacement Cost |

This amount is calculated as the sum of Replacement Rate and Modify Rate By figures multiplied by Measurement. This value is an indication of the cost to replace this Asset and not necessarily equal to the current value of the Asset. |

|

Standard Residual |

Displays the percentage of value left in an Asset when the Asset ends its life; specified in the Asset Type. |

|

Modify Residual By |

You can reduce or increase the percentage of Residual Life of an Asset. |

|

Manually Set |

Determines whether the Assessed Residual Value will be calculated or entered manually. |

|

Assessed Residual Value |

The value displayed here can be: •Entered manually to a value determined outside of Conquest - the Manually Set check box should be set to true •Calculated using information specified in Conquest. The calculation is done when an Asset is revalued or purchased. The formula is: Revaluation: (Replacement Cost Rate * measurement) * (Standard Residual percentage plus or minus Modify Residual by percentage) Purchased: Cost of purchase * (Standard Residual percentage plus or minus Modify Residual by percentage where the Standard Residual percentage is specified on the Asset Type and the Modify Residual on the Asset. Note that once the Residual Value is calculated, it only changes upon a further revaluation, or when manually set. |

|

Insured Value |

For recording the Insured Value of an Asset. |

|

Account Number |

A financial system Account Number can be recorded here. |

|

|

|