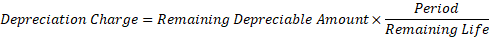

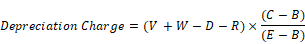

Depreciation charges are calculated using the following formula:

|

Category |

Component |

Database Column |

Alias |

|

Remaining Depreciable Amount |

Last Valuation |

tblAsset.Value |

V |

|

+ |

Accumulated Capital Works |

tblAsset.AccumCapitalWorks |

W |

|

- |

Accumulated Depreciation |

tblAsset.AccumDepreciation |

D |

|

- |

Residual Value |

tblAsset.ResVal |

R |

|

Period |

Closing Date |

tblValtrans.CloseDate |

C |

|

- |

Last Transaction Date |

|

B |

|

Remaining Life |

Expiry Date |

tblValtrans.Expiry |

E |

|

- |

Last Transaction Date |

|

B |

Duration in days is based on a “365.25” day year.

Note: From version 2.59 of the database, a new Depreciation Calculation method is included, where an Annual Charge is specified. This is additional to the current method, which calculates Remaining Depreciable Value over Remaining Life. To use it, change the Depreciation method from ‘End of life’ to ‘Annual Charge’. An asset will need a start point but not necessarily an Expiry, and will depreciate at the set percentage of its Total Value per year, no matter what its current life is. The Depreciation Rate is set for the Asset Type but can be set for individual Assets too, if so desired. The data is in tblTypes.DepRate and tblAsset.Deprate.

Example:

The calculation works out a year as 365.25 days (this allows for leap years). To calculate a daily amount this is then multiplied by the number of days in the batch depreciation. Therefore, your calculation is as follows

Base annual charge $212478.75 * 2% = $4249.5750

Calculated daily charge $4249.575 / 365.25 = $11.6347

Calculation for the period 2014/2015 $11.6347 * 365 = $4246.6655