|

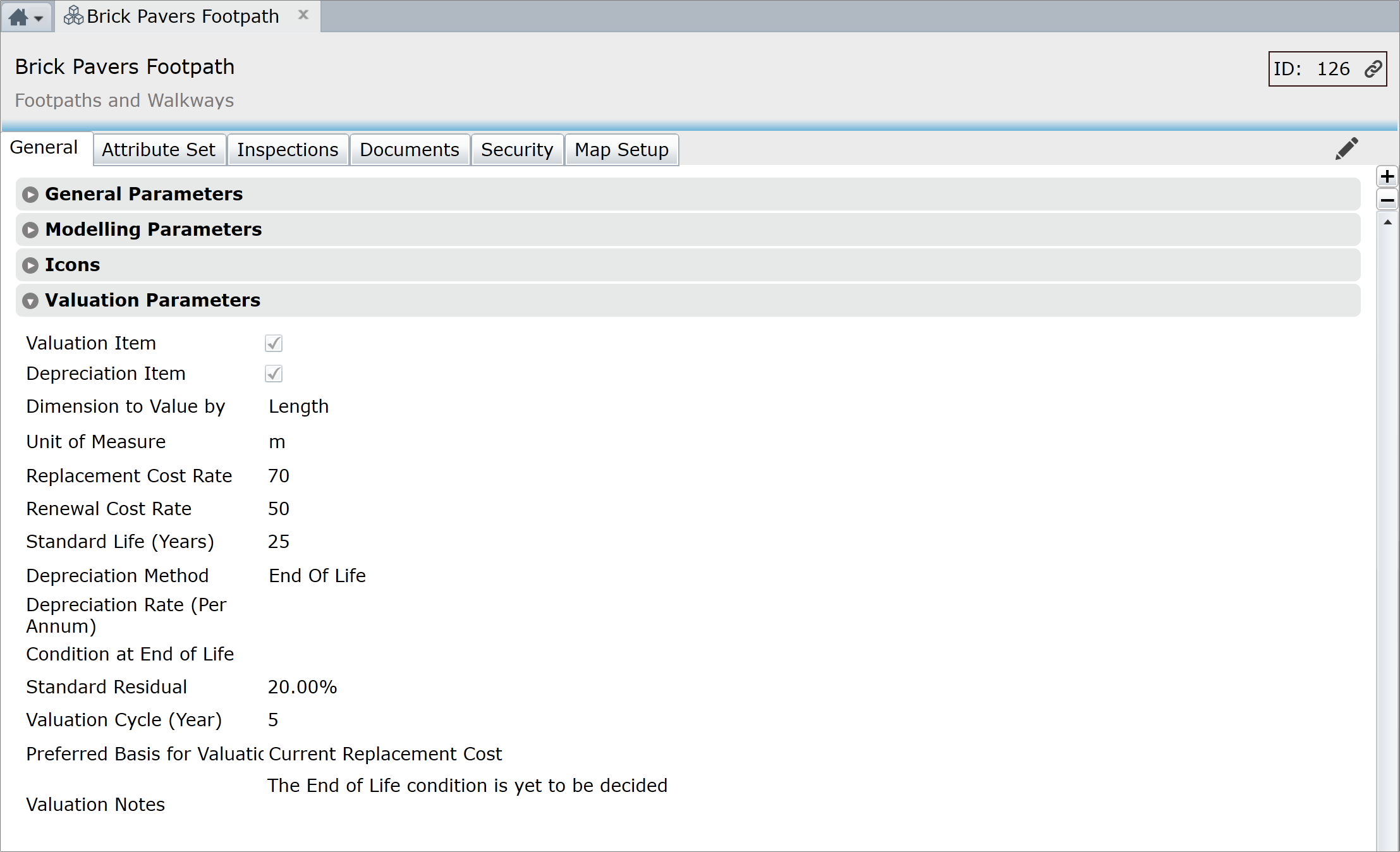

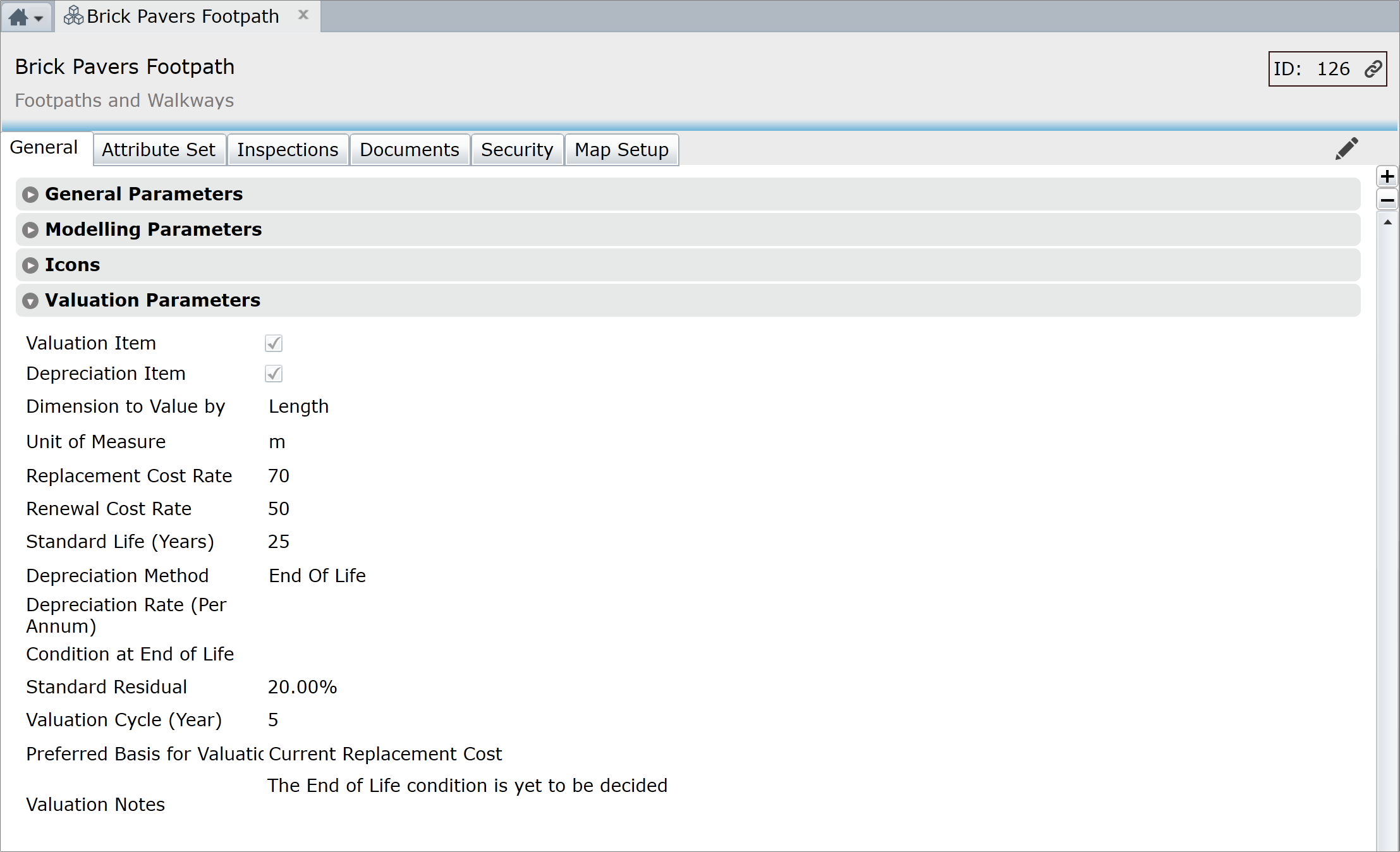

Header |

Description |

|

Valuation Item |

Tick this, so any Asset of this type can be a Valuation Asset and have Valuation Transactions. Unticked stops Assets of the Asset Type from being Valued. |

|

Depreciation Item |

For Valuation, tick this, so any Asset of this type is Depreciated and has Depreciation Transactions. |

|

Dimension to Value by |

One of the eight Dimension fields is selected for calculation of an Asset’s replacement cost. When set on an Asset, this Dimension is copied into the Measurement field. If the ‘Dimension To Value By’ Dimension column is included in an Import File of new ‘Existing’ Assets, both it and the Measurement column are given the same value from the Import File. If neither column is included in the Import File, the resulting Asset’s Measurement is set to 1. |

|

Unit of Measurement |

Displays the unit of measure from the selected Dimension to Value by, if it has one. If not then a unit can be selected from the generic Units List. |

|

Replacement Cost Rate |

This is the Standard Unit Rate. When multiplied by Dimension to Value By field of an Asset, gives its Replacement Value. |

|

Renewal Cost Rate |

The Renewal Cost, based on this rate, is displayed on the Asset in addition to the Replacement Cost |

|

Standard Life (Years) |

This determines the predicted life of an Asset of this type from new. |

|

Depreciation Method |

Depreciation Calculation methods: •Where an Annual Charge is specified, or •Remaining Depreciable Value over Remaining Life |

|

Depreciation Rate (Per Annum) |

The Depreciation Rate is set for the Asset Type but can be set for individual Assets too, if so desired. The data is in tblTypes.DepRate and tblAsset.DepRate |

|

Condition At End Of Life |

This specifies the expected condition for the Asset’s End of Life. |

|

Standard Residual (%) |

The percentage specified here is used to calculate the residual value of an Asset at revaluation or purchase. The result of the calculation is displayed on the Asset form in the Assessed Residual Value field. As it is a calculation field, please enter 0.1 for 10%. |

|

Valuation Cycle (Years) |

This determines how often Assets of this type are revalued. |

|

Preferred Basis for Valuation |

This drop down list shows the list of differing methods of valuation. Choosing one will display on the Asset Form the method by which the Replacement Cost was arrived at. |

|

Valuation Notes |

For recording standard Valuation Notes. |

|

|

|