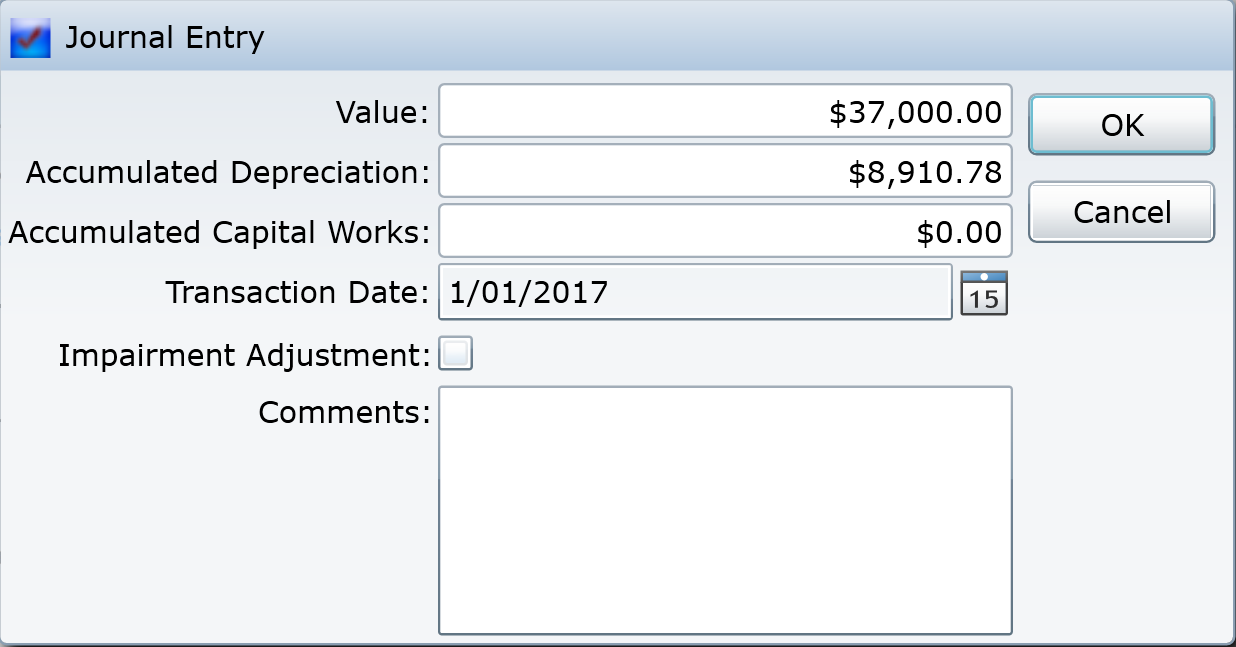

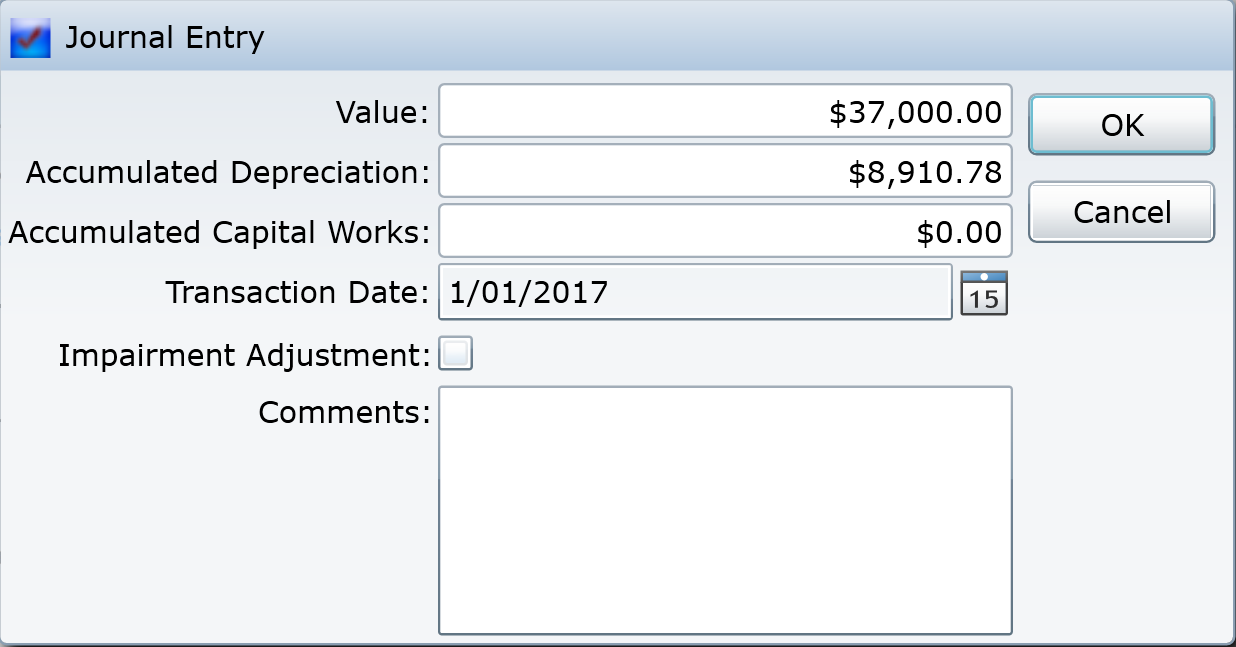

Open this form from a Valuation Asset, to make a manual adjustment to its valuation data

This function is to make Journal Adjustments to any of the valuation elements of an Asset, usually when the Valuation process was done outside of Conquest.

Take care to set all the values correctly, including any changes to Accumulated Depreciation.

Use the Impairment Journal Adjustment to allow for unforeseen changes in Residual Value. To do this tick the Impairment Adjustment checkbox, set the Transaction Date to the date of the event and increase the Accumulated Depreciation value to allow for the Impairment. An Accumulated Depreciation transaction is calculated up to that date, as it would be without the Impairment, then a Journal Transaction for the Impairment itself, directly setting the Accumulated Depreciation. The effect of this is a change to the Written Down Value.

Journal Adjustments are recorded as Asset Transactions.

|

Field |

Purpose |

|

Value |

Changing this number will revalue the Asset to the new amount at the date specified but will not depreciate it |

|

Accumulated Depreciation |

Adjusts the amount of depreciation incurred on this Asset |

|

Accumulated Capital Works |

Adjusts the Capital Works amount and the Depreciable Amount but will not adjust Accumulated Depreciation. |

|

Date |

The date of the transaction. |

|

|

|

For more information on Valuations and Transactions see How To Manage Financial Data