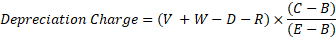

Depreciation charges are calculated using the following formula:

|

Category |

Component |

Database Column |

Alias |

|

Remaining Depreciable Amount |

Last Valuation |

tblAsset.Value |

V |

|

+ |

Accumulated Capital Works |

tblAsset.AccumCapitalWorks |

W |

|

- |

Accumulated Depreciation |

tblAsset.AccumDepreciation |

D |

|

- |

Residual Value |

tblAsset.ResVal |

R |

|

Period |

Closing Date |

tblValtrans.CloseDate |

C |

|

- |

Last Transaction Date |

|

B |

|

Remaining Life |

Expiry Date |

tblValtrans.Expiry |

E |

|

- |

Last Transaction Date |

|

B |

|

|

|

|

|

•Duration in days is based on a 365.25 day year.

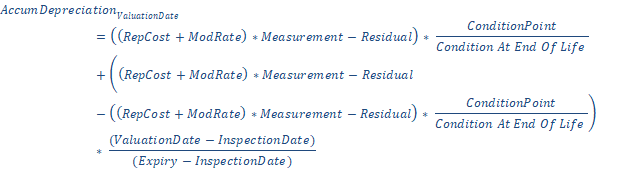

For Accumulated Depreciation; at valuation, the accumulated depreciation = (Current Replacement Cost – Residual Value) * Proportion of Life Consumed.

Therefore, for condition based calculation

With the Condition at Inspection Date Option, add on the depreciation charge between the inspection date and the valuation date: